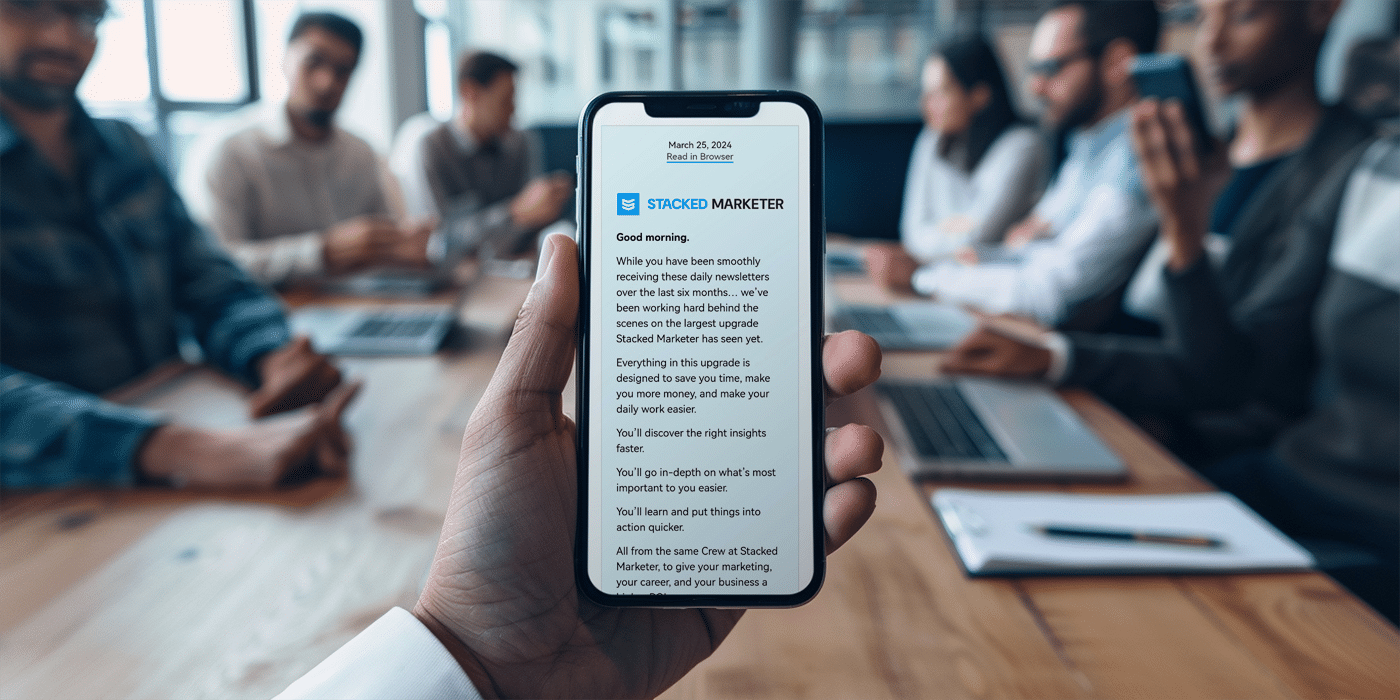

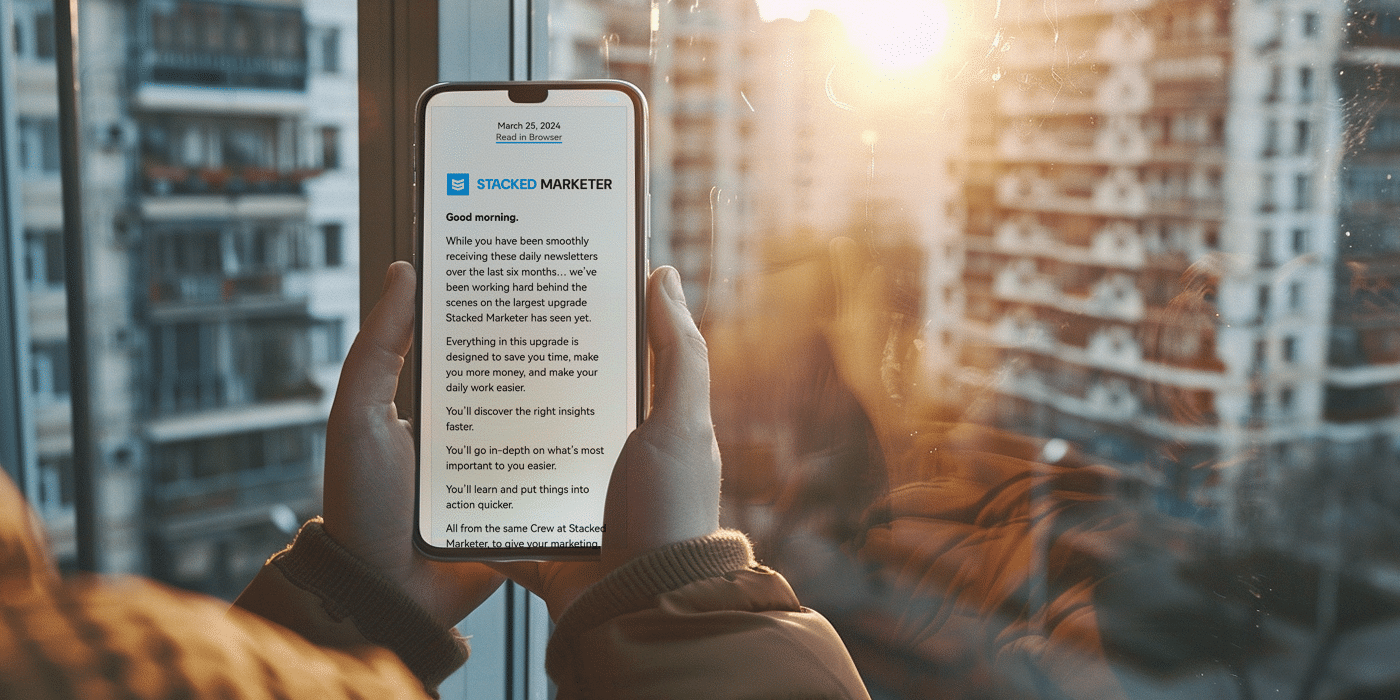

We will make you a smarter marketer for free

Delivered fresh every weekday, our carefully curated digital marketing news, tech, and actionable advice can be consumed in 7 minutes or less.

*By clicking Subscribe you agree to our Terms of Service and Privacy Policy

Join 60k+ marketers from:

Our mission is to provide every marketer with a free daily dose of news, trends, tech, and actionable advice in a super-easy-to-digest format, with transparency and quality as our core principles.

For digital marketers who:

- Run paid social ads on Facebook, Instagram, TikTok, and more.

- Run paid search campaigns on Google and Bing.

- Do email marketing.

- Do content marketing and SEO.

- Run an e-commerce store, digital agency, or online business.

- And want to be up to date with news, trends, and actionable advice in the digital marketing space.

Testimonials

What readers are saying

“The newsletter is the best thing I get in my inbox for years and years. Love it. The effort and love put into this is just off the charts.”

“They make it palatable. A lot of these things are technical dry material that they give a real, actually interesting perspective.”

“Stacked is on top of every single change happening in the industry and I regularly use their reporting to make better decisions for my teams.”

“They deliver so consistently and manage to find stories I haven’t found myself about things that matter to me is really impressive.”

“Stacked is my go-to to keep me up to date with my craft — the only resource I go out of my way to make time for!”

Join 60K+ readers and get fresh digital marketing news, tech, and advice every weekday.

100% Free.

No Spam.

Unsubscribe anytime.

Newsletter

Latest issues

🏖️ Pinterest searches.

April 24, 2024 Share on Sponsored by Good morning. Does it ever feel that writing short copy takes at least 10 times as long as writing long copy? SPOTIFY Just in: Spotify’s Q1 reports Seems Spotify had a pretty good quarter… The platform’s monthly active users (MAU) grew 19% year over year (YoY). When you…

🔨 Low-quality.

April 23, 2024 Share on Sponsored by Good morning. At first we thought we were watching a video of social media ads optimization. But then we took another sip of coffee and realized it was just a video of rickshaw racing. Anyone else feel like they can relate, or is it just us? SEARCH Links…

👻 Better than most.

April 22, 2024 Share on Sponsored by Happy Monday. Don’t forget to lend a hand to your fellow marketers this week. You know, sharing expertise, offering a resource, listening and empathizing with their challenges… that kind of thing. Sharing newsletters is always nice, too. Just saying. TIKTOK The US ban is becoming more real Dear…

👋 New assistant.

April 19, 2024 Share on Sponsored by Whew, it’s Friday. There are two words we’re terrified to say out loud in front of other people: Niche, and data. Honestly, do you know how to pronounce them properly? Does anyone? META More AI tools, more AI integration, and more upcoming ad space A healthy batch of…

🔗 Other accounts.

April 18, 2024 Share on Sponsored by Good morning. Remember to get up and walk around a bit today, OK? We keep seeing headlines about studies about the health risks of too much sitting, and… yikes. Scary. Marketing is awesome and everything, but breaks are nice too. VIDEO MARKETING YouTube gets a refurb, and a…

📺 Shoppable.

April 17, 2024 Share on Sponsored by Good morning. A creative director posted on X: “I am made up of 50% cold brew and 50% ibuprofen.” Relatable content. Except that we’re closer to 30% black coffee, 50% water, and 20% guacamole and chips. Whatever keeps the juices flowing, you know? E-COMMERCE Shoppable live streams are…